Timber: Introduction to the asset class

by George Nichols | June 22, 2008Timber products touch our lives on a daily basis, though few people have ever considered timber as a potential investment. That is gradually changing, however, as more investors discover the little-known fact that timber investments have generally outperformed stocks, bonds, and commodities over the long run.

How timber makes money

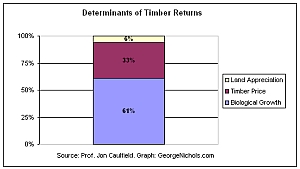

The defining attribute of timber is its steady, long-term biological growth. A tree's wood volume tends to increase 2% to 8% annually (varying by climate, species, and age). Compounding the effect of this biological growth, trees yield price gains when they grow into bigger product classes. For instance, a small tree that is only suitable for paper products may eventually grow into sawtimber, where it can fetch dramatically higher prices per ton and be used for products such as plywood or telephone poles.

An academic study found that biological growth drives more than 60% of total returns, while timber price changes and land appreciation account for the remainder of returns. [1]

(click on any graphic to see all graphics in full size)

Returns and Volatility

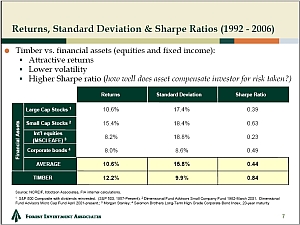

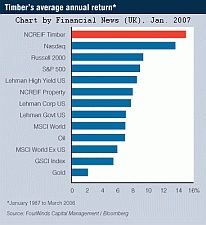

The NCREIF Timberland Index, the standard benchmark for this asset class, increased 18.4% in 2007, versus a 5.5% rise for the S&P 500. Longer term, the Timberland Index has outpaced all the major asset classes depicted in the adjoining graph (from Forest Investment Associates), except small-cap stocks. After factoring in volatility (as reflected in the Sharpe Ratio), timber has exhibited the highest risk-adjusted returns of the group. Timber returns have been particularly high over the past couple of decades, as illustrated in the second graph. [2]

Relative to the S&P 500, timber has exhibited low downside risk. Since its 1987 inception, the NCREIF Timberland Index has declined only in one year: -5.25% in 2001. By contrast, the S&P500 has fallen four times, including -22.10% in 2002.

Diversification, correlations, and inflation hedges

Timber can also improve a portfolio's risk-adjusted returns by virtue of its fairly low correlation to most asset classes. This low correlation reflects the fact that the primary driver of returns -- biological growth -- is unaffected by economic cycles.

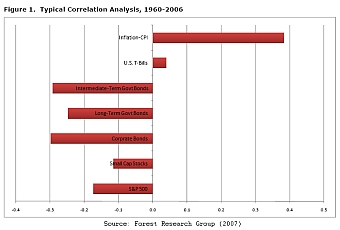

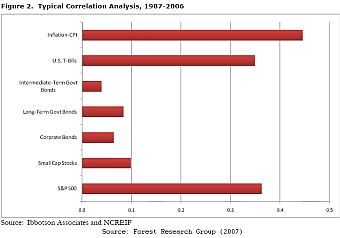

Correlation statistics have varied greatly depending on the time period, as you can see from the graphs below by Jack Lutz of the Forest Research Group. While the 1960-2007 numbers give an idea of long-term results, pre-1987 returns are based on a simulated index rather than actual returns, so post-1987 figures may give a better indication of what to expect in the future. [3]

Timber also exhibits a moderate correlation to inflation, and research indicates timber assets may serve as a good long-term hedge against unanticipated inflation.

More tax efficient than other portfolio diversifiers

Like stock gains, timber gains are generally taxed at the capital gains rate (usually 15%) rather than the ordinary rate (typically 25%), so investors in taxable accounts take home a greater proportion of gains. By contrast, much of the typical returns from bonds, non-timber real estate investment trusts (REITs), and commodities futures contracts is taxed at ordinary rates.

Risks

Physical risks -- such as damage from fire or insects -- can inflict significant losses, but not to the extent that many investors fear. Such losses usually erode returns by 0.1% annually, for timberland holdings that are well-diversified by geography, age, and species. [4]

In my view, the greatest risks are: 1) overpaying for timber assets and 2) illiquidity (inability to readily sell assets).

Overpayment/valuation risk

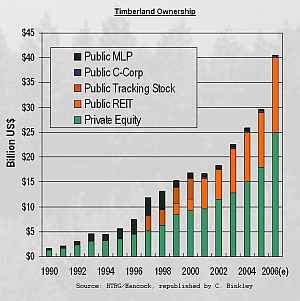

No longer a "well-kept secret," timber has been attracting plenty of assets from large institutions and ultra-wealthy investors.

This influx of money is chasing after a limited number of forests. This is particularly the case in the US -- American forest-product conglomerates largely finished divesting millions of acres of forests in the past decade. Thus, investors are increasingly looking overseas for deals.

Steve Holland, portfolio manager for the Campbell Group, told me in an e-mail interview that while there are opportunities overseas, they involve "political, currency, and tax risks." Holland, who also serves as the NCREIF Timberland committee chair, says that currently "the US is still the best place to invest, but over time institutional ownership of timberland on a global basis will become more prevalent." [5]

Illiquidity risk

Timber is strictly an asset class for long-term investors rather than speculators seeking a quick buck. Trees generate most of their returns through steady biological growth, and harvesting cycles are typically 15 to 40 years. Also, timber assets are difficult to sell quickly. As I'll explain in my next article, some pure-play timber investment vehicles limit the timing or amount of sales by shareholders.

References / Footnotes

1. Real Estate Finance, "Timberland Return Drivers and Investing Styles for an Asset that has Come of Age," Winter 1998

2. I would caution investors that timber returns from the late-1980s to the early-1990s were inflated by supply shocks from federal conservation efforts to protect the spotted owl. So, the 1987-2006 graph highlights abnormally high returns, while the 1992-2006 graph seems a bit more realistic.

3. Pre-1987 returns were extrapolated for the John Hancock Timber Index, as explained in this 2003 white paper (pdf) from Hancock Timber Resource Group.

4. However, a dramatic infestation of mountain pine beetles is killing entire forests in Western Canada and the Western US, primarily old lodgepole pines. This underscores the importance of diversifying by geography, age, and species.

5. E-mail interview excerpt, June 16, 2008, reprinted with permission.